Welcome sellers and buyers, Mobile Home Purchase Contracts Inside Parks.

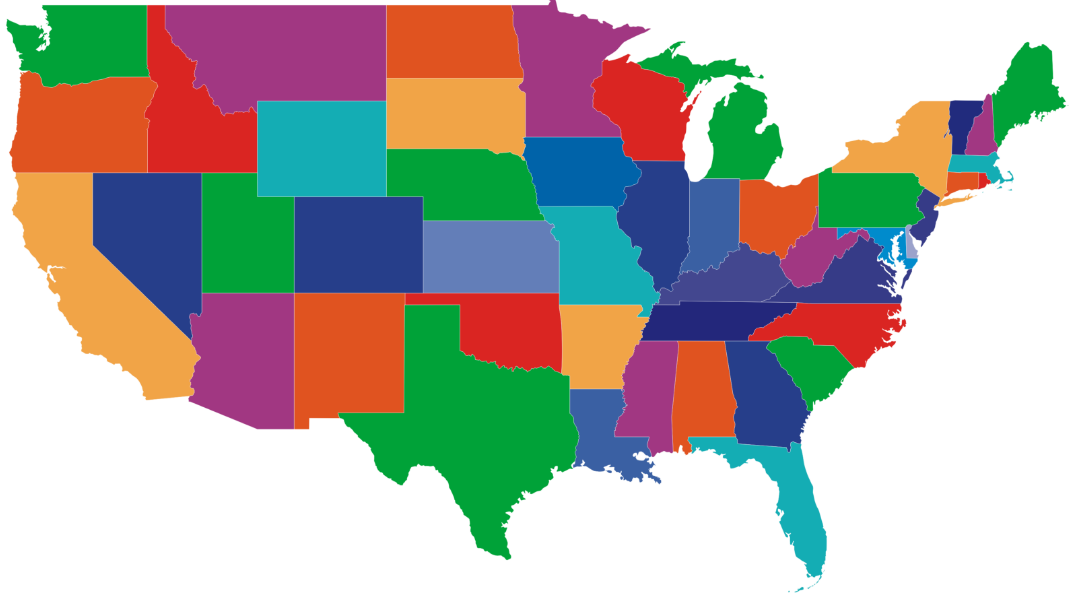

Depending on which state your mobile home is located, the buying and/or selling ownership process will likely vary. In some states this process will even vary slightly from county to county. Aim to have clarity and know the correct steps moving forward whether buying or selling a manufactured home inside of a park. In today’s lesson we will outline many of the steps needed to move forward when transferring mobile home ownership between a mobile home buyer and a mobile home seller.

Purpose of this page

To provide help and clarity to private buyers and private sellers. Below you will find the minimum paperwork needed to transfer a mobile home’s ownership successfully in your state. We hope this is helpful.

Mobile Home Disclaimer: This article and the links below discuss only mobile homes located in pre-existing mobile home parks, and other mobile homes considered personal property, with the exception of New Hampshire and Rhode Island. However, if you are selling a mobile home & land together then please click this sentence.

Investor Disclaimer: This article is not ideal for mobile home investors. As investors we ideally want to take a number of precautions while creating win-win deals and preparing custom paperwork advantageous to investors. For this reason there are additional forms not mentioned on this page or any of the links below. These additional forms active mobile home investors may need include: Additional disclosures, agreements after closing, personal property agreements, transfer documents, truth in lending forms, buyer/seller repair contracts, lien paperwork, closing checklists, addendums, note paperwork, security contracts, seller brochures, power of attorneys and more.

Popular mobile home forms that may be required:

✔ Title(s): In some states titles are used to prove and transfer ownership from one mobile home owner to the next. Many times this is a state printed Title and is printed on letterhead directly from the state. A mobile home title often contains the mobile home’s serial number, Vehicle identification number (VIN), age, make, model, size, address, date of title, date of last title, and also an area for the buyers and seller’s signature. Often times this paper title needs to be protected and kept in a safe place away from thieves. A duplicate title may likely be ordered directly from the state for a fee. In some states older mobile homes no longer require titles. These paper titles are very similar to automobile titles in some state. In some states a double-wide mobile home will have two titles, and in other states double-wide mobile home will have one title. In some states a double-wide mobile home may have one or two titles depending on when the current title was issued. Some title signatures may need to be notarized.

✔ Tax certificate: In some states a mobile home buyer or seller must obtain physical proof that the current property taxes have been paid on this particular mobile home. In some states this is called a tax clearance, tax receipt, tax certificate, etc. If required, this form can often be attained at the local taxing authority in the local municipality. This form will only be released when the taxes are current and paid in full.

✔ Title application: In some states a title application must be filled out and signed by all parties in order to transfer title/ownership. In other states no title application is needed, or only the buyer’s signature is required.

✔ Bill of Sale: In some states a Bill of Sale is used as extra proof that the buyers and sellers legally met together to sell a mobile home from one person to another. A Bill of Sale should contain the mobile home’s serial number or VIN, the buyer and seller’s information, a purchase price and date, any guarantee or personal property that comes with the mobile home, and signatures of all the buyers and sellers. In some states the buyers and seller’s signatures may need to be notarized on the Bill of Sale.

✔ Registration: In some states there is a yearly or biannual registration tax bill that is due for every mobile home in a park. This likely may include local property taxes as well as a school tax or more. This registration bill must be paid by the owner and may result in penalties or complications if not paid by the date due.

✔ Lien release: If there is a current outstanding lien that is showing as “active” on the mobile home title this will have to be corrected. A lien release with adequate pay-off proof and/or signature from the lienholder may be needed for any future sale to go through successfully. Once this new title is printed in the new buyer’s name, this old (paid-off) lien will not be present any longer.

✔ Warranty Deed: Some states recognize mobile homes inside pre-existing mobile home parks not as personal property, but as real property. This requires the use of Deeds and Warranty Deeds to transfer ownership from seller to buyer.

✔ Additional paperwork: Additional paperwork and forms may be needed in a variety of situations or when particular obstacles arise. If a mobile home you own or are purchasing is owned 100% by the current owner, without any active liens, and all the taxes paid in full then there may not be any extra paperwork needed to sell from a private buyer to a private seller. However if the mobile home is coming from out of state, has to be moved, was not titled correctly in the past, has other title issues, is being evicted from it’s current location, has outstanding taxes due, has current liens, is listed as bonded, or there is no title, this could cause other forms to be needed to transfer ownership.

✔ Procedures: Mobile home closing procedures will absolutely vary from state to state. Please see the list of states below. We are currently updating the links below to provide the most current description of the basic steps required to transfer a mobile home from one party to another within your state.

If your state is not clickable please be patient as we upload these instructions and pages. For any corrections or questions in the meantime please reach out to support@mobilehomeinvesting.net.

Love what you do daily,

John Fedro

support@mobilehomeinvesting.net